per capita tax definition

Receipt A document which the union provides to confirm that money has been collected or which a vendor provides to confirm that goods or services have been provided to the union. Calculating per capita entails taking into account a measurement or number amount by which you will then divide by the total population of the group wishing to be analyzed.

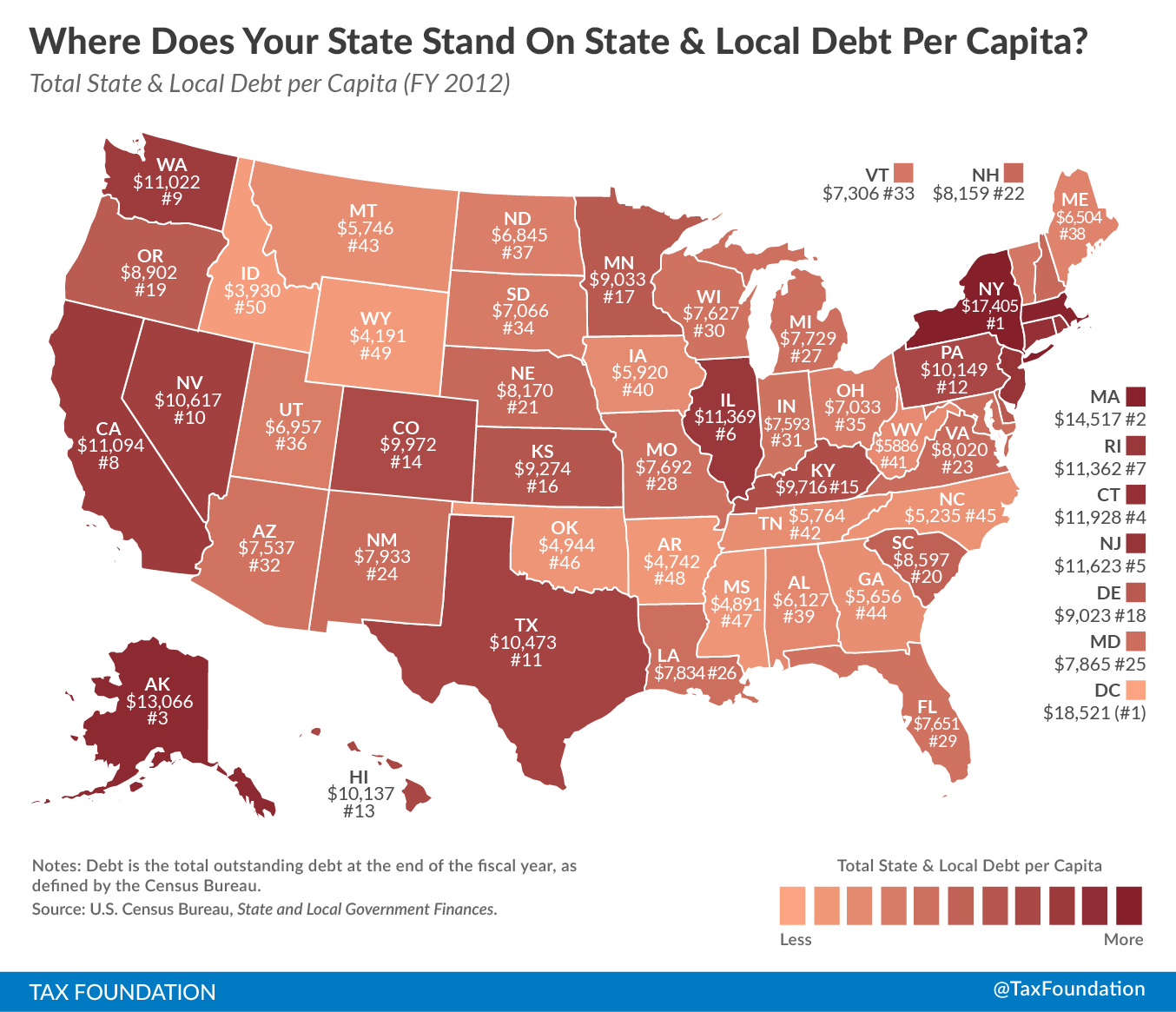

Where Does Your State Stand On State Local Debt Per Capita Tax Foundation

Per Capita Latin By the heads or polls A term used in the Descent and Distribution of the estate of one who dies without a will.

. GDP at purchasers prices is the sum of gross value added by all resident producers in the economy. The following formula can be used to determine the per capita. Per capita tax A per member assessment usually by a parent body that unions must remit periodically.

For most areas adult is defined as 18 years of age and older though in some areas the minimum age may differ. Per capita is a Latin expression that literally means of heads or for each head and is used idiomatically to mean per person. What is the Per Capita Tax.

A share wont be created for the deceased beneficiary and all the other beneficiaries shares will be increased accordingly if one of the identified group is deceased. An international dollar has the same purchasing power over GDP as the US. There are a few ways to.

Per Capita means by head so this tax is commonly called a head tax. In a per capita distribution an equal share of an estate is given to each heir all of whom stand in equal degree of relationship from a decedent. Learn what the GDP is and how a countrys overall GDP doesnt always accurately show how prosperous a country is for those living there.

In these days of diminishing resources and tight budgets the Presbyterian Church USA continues to seek new and innovative ways to provide ministry and support to mid councils presbyteries and synods across the country. Income per capita is the average earnings per person in a geographic region such as a city state or country. An order to buy or sell a security that due to its abnormally large size has the potential to have a significant effect on a securitys price.

The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Total tax revenue as a percentage of GDP indicates the share of a countrys output that is collected. Due to return processing delays relating to the erroneous assertion of self-employment tax on per capita distributions to tribal members the Service has developed a solution which involves wording that must be entered on Line 21 of Form 1040.

Means that as- pect of a plan which pertains to the in- dividualization of the judgment funds in the form of shares to tribal members or to individual descendants. Tax revenue is defined as the revenues collected from taxes on income and profits social security contributions taxes levied on goods and services payroll taxes taxes on the ownership and transfer of property and other taxes. The highest state and local property tax collections per capita are found in the District of Columbia 3740 followed by New Jersey 3378 New Hampshire 3362 Connecticut 3107 New York 3025 and.

Define Per capita payment. GDP is gross domestic product converted to international dollars using PPP rates. By or for each individual a high per capita tax burden.

GDP per capita PPP GDP per capita is based on purchasing power parity PPP. Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction. Both taxes are due each year and are not duplications.

The term is used in a variety of social science and statistical research contexts including government statistics economic indicators and. It divides the countrys gross domestic product by its total population. Do I pay this tax if I rent.

Per unit of population. Is this tax withheld by my employer. Per capita Unit Number of people in a population.

The gross domestic product per capita or GDP per capita is a measure of a countrys economic output that accounts for its number of people. On average state and local governments collected 1675 per capita in property taxes nationwide in FY 2018 but collections vary widely from state to state. ISSUE This report shows how Connecticut ranks among the states on net-tax supported debt NTSD per capita and summarizes recent state efforts to increase their capacity to afford debt.

Per capita GDP is a global measure for gauging the prosperity of nations and is used by economists to analyze the prosperity of a country based on its economic growth. It can apply to the average per-person income for a city region or country and is used as a means of. Income per capita is a measure of the amount of money earned per person in a certain area.

It means to share and share alike according to the number of individuals. Learn how to define income. Dollar has in the United States.

Whether you rent or own if you reside within a taxing district you are liable to pay this tax to the district. A Per Capita tax is a flat rate tax equally levied on all adult residents within a taxing district. Connecticut s NTSD per capita in 2014 was 5491 which ranked Connecticut first among the states based on this debt affordability measure according to Moody s Investors.

Normally the Per Capita tax is NOT. It is not dependent upon employment. Per capita is Latin for by head All the living members of the identified group will receive an equal share if the beneficiaries are to share in a distribution per capita.

Presbyterians have used per capitaan annual per member apportionment assessed by the General Assembly Book of Order G. The school district as well as the township or borough in which you reside may levy a per capita tax.

Key Aspects Of Per Capita Personal Income

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

Property Tax Definition Learn About Property Taxes Taxedu

Property Tax Definition Learn About Property Taxes Taxedu

Information About Per Capita Taxes York Adams Tax Bureau

Per Capita Definition Formula Examples And Limitations Boycewire

Tax Base Definition What Is A Tax Base Taxedu

/dotdash_Final_Gross_National_Income_GNI_May_2020-01-53d357d45bae47f29d3c72a98f190f8d.jpg)

Gross National Income Gni Definition

/dotdash_Final_Gross_National_Income_GNI_May_2020-01-53d357d45bae47f29d3c72a98f190f8d.jpg)

Gross National Income Gni Definition

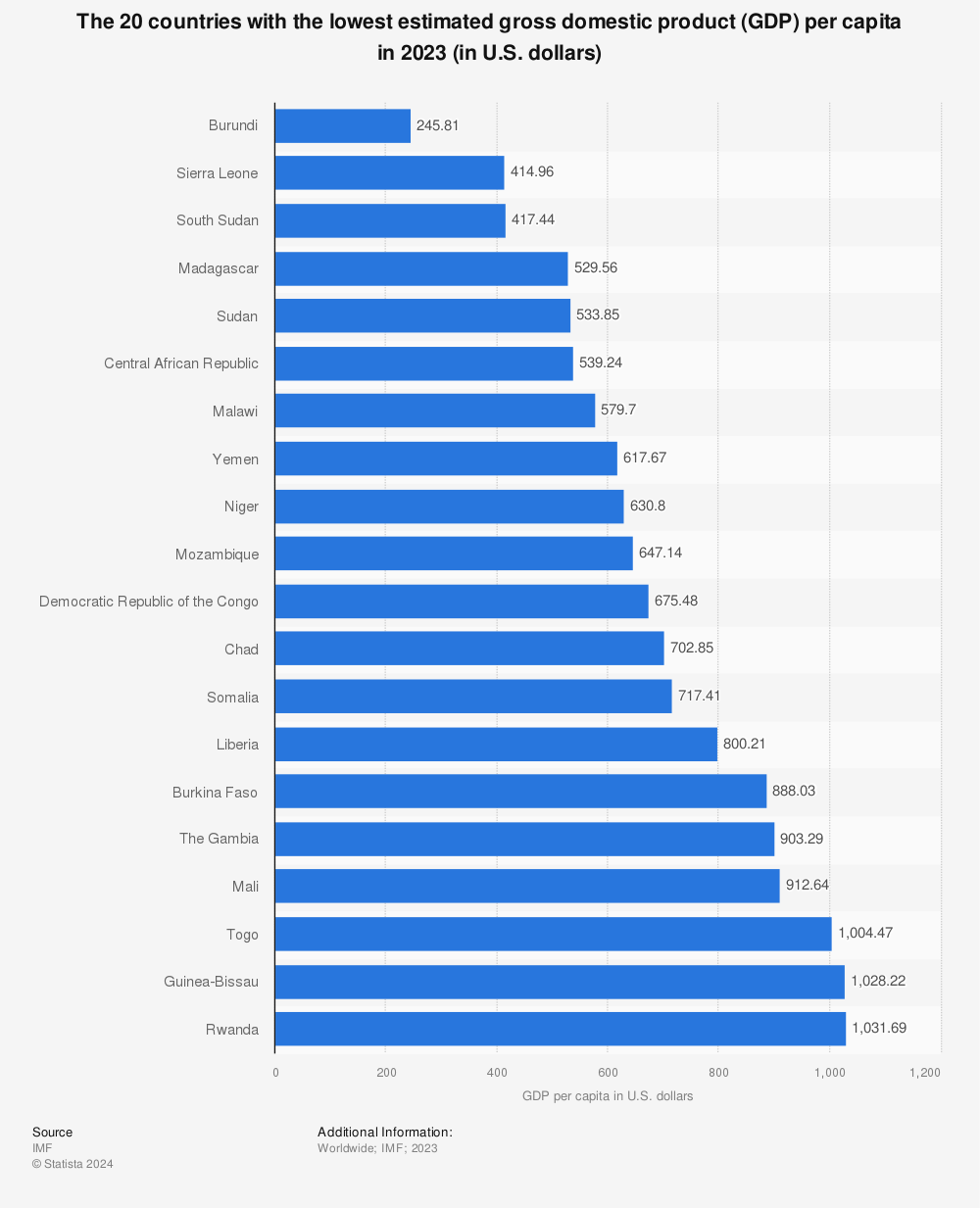

Top 20 Lowest Gdp Countries 2017 Statista

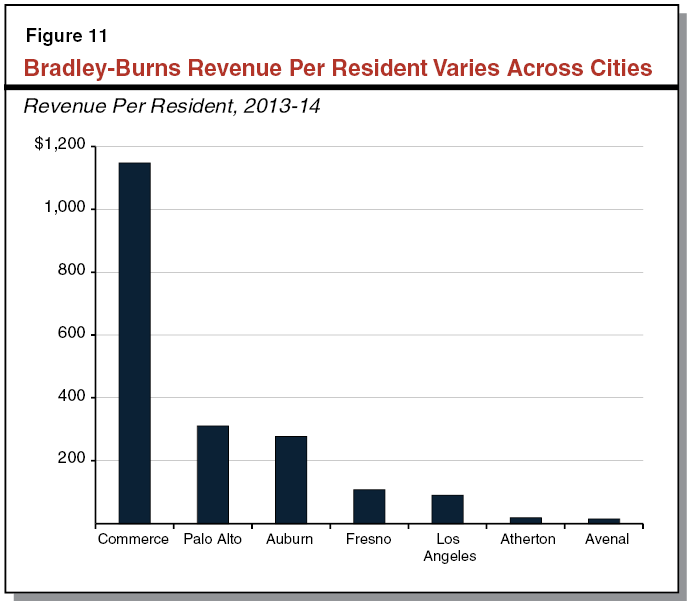

Understanding California S Sales Tax

Washington From Affluence To Prosperity Economic Opportunity Institute Economic Opportunity Institute

/GettyImages-545863985-e964b845dce944dfb2b94153aab83a7a.jpg)